Online education’s expansion created unprecedented access to legitimate high-quality degrees from respected universities, but simultaneously enabled proliferation of diploma mills, predatory institutions, and questionable programs extracting money from vulnerable students while delivering worthless credentials employers don’t recognize. These fraudulent operations charge $15,000-45,000 for degrees completed in weeks with minimal coursework, promise guaranteed acceptance and degree completion, advertise life experience credits converting work history into academic degrees without assessment, operate without legitimate accreditation despite claiming “accredited” status from organizations they control, and leave students with crushing debt financing worthless credentials damaging rather than advancing careers. The consequences prove devastating—students waste years and tens of thousands of dollars on credentials employers reject, face difficulty transferring earned credits to legitimate institutions, struggle repaying student loans for education providing no career benefit, and sometimes face professional licensing barriers when boards reject questionable degrees. However, informed consumers can protect themselves by understanding accreditation systems distinguishing legitimate from fraudulent institutions, recognizing warning signs predatory programs display, verifying institutional legitimacy through federal databases and state authorization, evaluating transparency around costs and outcomes, and applying consumer protection principles ensuring educational investments deliver genuine value. This comprehensive consumer protection guide reveals specific red flags identifying diploma mills and predatory institutions, explains accreditation frameworks validating institutional quality, demonstrates verification methods confirming program legitimacy, examines financial aid regulations protecting students from fraud, and provides actionable frameworks enabling prospective students to distinguish quality affordable online education from expensive worthless credentials masquerading as legitimate degrees through deceptive marketing exploiting information asymmetries between sophisticated predatory operators and vulnerable consumers seeking educational advancement.

Understanding diploma mills and their harmful impact

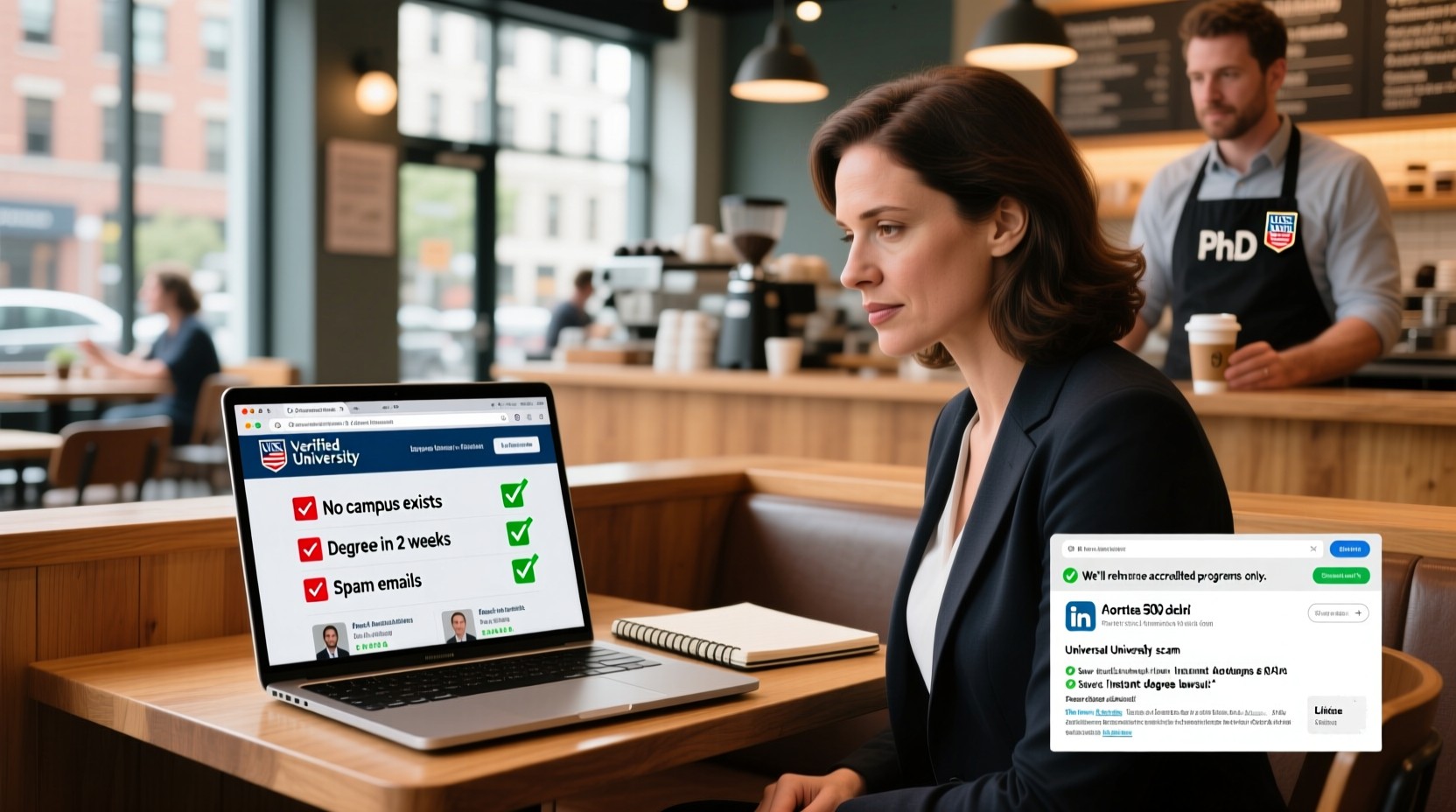

Diploma mills operate businesses selling degrees requiring minimal or no academic work, offering credentials based primarily on payment rather than learning achievement. These operations charge thousands of dollars for degrees completed in weeks or months through “life experience portfolios” converting work history into academic credits without rigorous assessment, correspondence courses requiring minimal effort, or outright credential purchasing without coursework. They claim accreditation from organizations they control or fabricate, create impressive-sounding names mimicking legitimate universities, and market aggressively to working adults seeking credential advancement. The credentials they issue appear superficially legitimate but lack recognition from employers, professional licensing boards, and legitimate educational institutions.

The damage diploma mills create extends beyond wasted money to serious career harm. Employers discovering diploma mill credentials often terminate employees for credential fraud even when employees believed degrees were legitimate. Professional licensing boards reject applications based on unaccredited degrees, preventing licensure in fields like nursing, teaching, and counseling regardless of actual competence. Graduate schools refuse admission or revoke degrees when discovering undergraduate credentials came from diploma mills. Student loan debt remains despite worthless credentials, with borrowers unable to discharge loans in bankruptcy. According to research from the U.S. Department of Education’s Office of Postsecondary Education on accreditation, students who unknowingly attended diploma mills report average financial losses of $35,000-65,000 in worthless tuition payments plus 3-7 years delayed career advancement from pursuing fraudulent credentials instead of legitimate education, demonstrating that diploma mill costs extend far beyond direct financial payments to encompass devastating opportunity costs and career damage.

Why diploma mills persist despite obvious fraud

Diploma mills exploit information asymmetries where sophisticated operators understand accreditation complexities and regulatory loopholes while vulnerable consumers lack knowledge distinguishing legitimate from fraudulent institutions. They target working adults seeking credential advancement who may not have attended college previously and don’t understand warning signs. Regulatory enforcement proves challenging because diploma mills operate internationally beyond U.S. jurisdiction, quickly close and reopen under new names when facing scrutiny, operate in regulatory gray areas where states and federal government share enforcement responsibilities, and claim religious or vocational exemptions avoiding oversight. Marketing sophistication creates legitimacy appearance through professional websites, official-sounding names, fake testimonials, and fabricated accreditation claims. By the time students realize credentials are worthless, operators collected tuition and moved on, leaving victims with no recourse for recovery. Protection requires consumer education enabling prospective students to identify red flags before enrolling rather than relying on regulatory enforcement that consistently fails to eliminate diploma mill operations faster than new fraudulent institutions emerge.

Accreditation types and legitimacy verification

Accreditation represents quality assurance where external organizations evaluate institutions against academic standards, ensuring educational programs meet minimum quality thresholds. However, not all accreditation proves legitimate—understanding accreditation types distinguishes genuine quality validation from diploma mill deception. Regional accreditation from agencies like Middle States Commission on Higher Education, Higher Learning Commission, or Southern Association of Colleges and Schools represents gold standard for traditional universities and colleges. National accreditation from legitimate agencies like Distance Education Accrediting Commission serves specialized institutions. These recognized accreditors undergo approval from Council for Higher Education Accreditation (CHEA) or U.S. Department of Education, ensuring accrediting bodies themselves meet quality standards.

Diploma mills create fake accreditation from organizations they control or invent, using official-sounding names like “International Accreditation Organization” or “World Education Accreditation Commission” that appear legitimate but lack CHEA or Department of Education recognition. They claim “accredited” status technically true in sense that some entity accredited them, but that entity lacks legitimacy making accreditation meaningless. Verifying accreditation requires checking institution’s claimed accreditor against Department of Education’s Database of Accredited Postsecondary Institutions and Programs or CHEA’s database. According to accreditation research from Council for Higher Education Accreditation, 87% of diploma mill victims report believing their institution held legitimate accreditation because they didn’t verify accreditor recognition, demonstrating that simple verification step using federal databases prevents most diploma mill enrollment by revealing fraudulent accreditation claims before students invest money and time in worthless credentials.

| Accreditation type | Legitimacy indicators | Recognition by employers/schools | Verification method |

|---|---|---|---|

| Regional accreditation (HLC, MSCHE, SACSCOC, etc.) | Recognized by US Dept of Education and CHEA | Universally recognized – gold standard | Check Department of Education database |

| Legitimate national accreditation (DEAC, ABHES, etc.) | Recognized by US Dept of Education or CHEA | Generally recognized, some transfer limitations | Verify on CHEA or Department of Education lists |

| Programmatic accreditation (ABET, ACBSP, etc.) | Supplements institutional accreditation for specific fields | Recognized in specific professions | Check with relevant professional associations |

| International accreditation (varies by country) | Legitimate in home country, limited US recognition | May not transfer to US institutions, employer dependent | Research specific accreditor and country standards |

| Fake accreditation (diploma mill controlled) | NOT recognized by US Dept of Education or CHEA | Not recognized – credential worthless | Absence from official databases reveals fraud |

| Religious exemption (unaccredited) | May operate legally but lacks quality oversight | Limited recognition, degree validity questionable | Research specific institution reputation carefully |

Warning signs identifying predatory institutions

Predatory institutions display identifiable patterns distinguishing them from legitimate universities. Guaranteed admission regardless of qualifications signals absence of academic standards—quality institutions maintain selective admission ensuring students possess prerequisite knowledge for program success. Promises of degree completion in unrealistically short timeframes (bachelor’s degrees in 6 months, doctorates in 1 year) indicate credentials awarded without genuine learning. Heavy emphasis on “life experience credits” converting work history into academic degrees without rigorous portfolio assessment or examination suggests degree purchasing rather than education. Pressure tactics creating artificial urgency through limited-time offers, enrollment deadlines, or “scholarships” expiring immediately reveal manipulative sales approaches rather than educational mission.

Additional red flags include inability to provide specific faculty credentials or course syllabi, vague descriptions of learning outcomes and assessment methods, unwillingness to discuss accreditation specifics or provide accreditor contact information, aggressive recruiting through unsolicited emails or phone calls, and resistance when prospective students ask detailed questions about program requirements, costs, or outcomes. Legitimate institutions welcome informed prospective students asking detailed questions and provide transparent information about accreditation, faculty, curriculum, costs, and graduate outcomes. According to consumer protection research from the Federal Trade Commission’s Bureau of Consumer Protection, students who report experiencing 3+ warning signs during recruitment but enrolled anyway suffer diploma mill or predatory institution victimization 94% of the time, indicating that warning sign recognition combined with willingness to walk away from suspicious programs provides nearly complete protection against fraudulent operations.

Critical red flags demanding immediate skepticism

Certain warning signs prove so indicative of diploma mills or predatory institutions that their presence should trigger immediate investigation or program abandonment. Absolute red flags include: Institution’s accreditor doesn’t appear in Department of Education or CHEA databases (diploma mill fake accreditation), degrees granted primarily for “life experience” without rigorous assessment (credential purchasing), guaranteed admission with no application requirements or transcript review (no academic standards), completion timeframes inconsistent with credit hours claimed (4-year degree in 6 months mathematically impossible), inability to provide physical campus address or operating from mail drop (fly-by-night operation), faculty credentials unavailable or consisting of degrees from the same institution (circular credentialing), aggressive recruiting through unsolicited contact with high-pressure enrollment tactics (predatory sales rather than education), tuition due in full upfront without financial aid options (cash grab), and institutional name closely mimicking respected university (intentional confusion). Any single red flag warrants careful investigation; multiple red flags indicate near-certain diploma mill or predatory institution requiring immediate rejection regardless of marketing promises or claimed legitimacy.

Legitimate accreditation databases and verification

Protecting against diploma mills requires active verification rather than accepting institutional claims at face value. The U.S. Department of Education maintains Database of Accredited Postsecondary Institutions and Programs publicly searchable online, listing all institutions holding recognized accreditation. Search for prospective institution by name—if it doesn’t appear, accreditation is either fake or from unrecognized accreditor making credentials questionable. Council for Higher Education Accreditation maintains similar database of accredited institutions and recognized accrediting organizations. These official databases provide definitive verification—institutional absence indicates serious credential legitimacy concerns regardless of marketing claims.

Beyond accreditation verification, state authorization provides additional legitimacy confirmation. States require institutions operating within their borders to obtain authorization ensuring compliance with consumer protection regulations. The State Authorization Reciprocity Agreement (SARA) facilitates interstate online education while maintaining oversight, with participation indicating institutional commitment to regulatory compliance and consumer protection. Federal Student Aid participation offers another legitimacy indicator—institutions approved for federal financial aid underwent Department of Education review verifying basic quality standards and financial stability. According to regulatory compliance research from Federal Student Aid office, institutions holding legitimate regional accreditation, state authorization, and federal financial aid approval represent 99.7% of legitimate higher education while diploma mills almost never meet all three criteria, making this verification trinity highly effective filter eliminating fraudulent operators while confirming institutional legitimacy.

Step-by-step verification process before enrolling

Protect yourself through systematic verification: Step 1 – Visit U.S. Department of Education’s Database of Accredited Postsecondary Institutions (ope.ed.gov/dapip) and search institution by name, confirming listing with recognized accreditor. Step 2 – Visit accreditor’s website directly (don’t rely on links from institution) and search their accredited institution list, verifying institution appears. Step 3 – Check Council for Higher Education Accreditation database (chea.org) confirming accreditor itself holds recognition. Step 4 – Verify state authorization through your state’s higher education commission or SARA membership list if applicable. Step 5 – Search institution on Federal Student Aid’s website confirming financial aid eligibility. Step 6 – Google institution name plus “diploma mill,” “lawsuit,” “complaint,” or “accreditation issues” reviewing results for warning signs. Step 7 – Check Better Business Bureau and state attorney general consumer complaint databases for patterns. Step 8 – Research institution on forums like Reddit, College Confidential, or GradCafe reading authentic student experiences. This verification takes 30-45 minutes but prevents years of consequences and tens of thousands in losses from diploma mill victimization.

Cost transparency and value assessment

Legitimate institutions provide clear transparent pricing specifying tuition per credit hour or term, mandatory fees, and total program costs without hidden charges discovered after enrollment. They explain financial aid options including federal loans, institutional scholarships, and payment plans. Cost information appears prominently on websites and in communications without requiring enrollment to discover actual prices. Predatory institutions often obscure costs through complex fee structures, bait-and-switch tactics advertising low tuition but charging excessive fees, or promising scholarships that disappear or prove far smaller than initially suggested. They pressure immediate enrollment before students can compare costs across institutions or calculate total program expense.

Value assessment requires comparing costs against expected outcomes—graduate employment rates, average starting salaries, debt-to-income ratios, and employer recognition. Legitimate institutions increasingly provide outcome data through gainful employment disclosures, graduate surveys, and placement statistics. Predatory programs resist transparency, providing vague claims about graduate success without verifiable data. Red flags include costs significantly exceeding comparable programs at established institutions without justification, resistance to providing total program cost estimates, inability to discuss typical graduate outcomes, and claims that outcomes data doesn’t exist or is confidential. According to consumer economics research from the National Center for Education Statistics IPEDS Data Center, legitimate online programs from regionally accredited institutions average $300-600 per credit hour ($36,000-72,000 for 120-credit bachelor’s) while diploma mills often charge $15,000-45,000 for “accelerated” degrees completed in months—appearing cheaper but delivering zero value making per-dollar cost infinite when credentials prove worthless.

| Cost characteristic | Legitimate institution practices | Predatory institution warning signs | Verification method |

|---|---|---|---|

| Tuition transparency | Clear per-credit or per-term pricing on website | Vague pricing requiring enrollment to discover costs | Check website for published tuition schedule |

| Total cost disclosure | Provides estimated total program cost including fees | Advertises low tuition but adds excessive undisclosed fees | Request detailed cost breakdown before enrolling |

| Financial aid | Participates in federal student aid, explains all options | Offers only private loans or payment plans, no federal aid | Verify Federal Student Aid participation |

| Scholarships | Clear eligibility criteria and amounts | Promises large scholarships that shrink or disappear | Get scholarship commitment in writing before enrolling |

| Refund policy | Clear refund schedule for withdrawal | No refunds or minimal refund with complex restrictions | Review refund policy in writing before paying |

| Payment timing | Pay by term or installment with clear schedule | Demands full payment upfront or large deposits | Never pay full program cost before starting |

Graduate outcome transparency and employment claims

Legitimate institutions track and disclose graduate outcomes including employment rates, fields of employment, average salaries, graduate school admission rates, and professional licensure passage rates. They provide this data transparently recognizing prospective students deserve outcome information before making enrollment investments. Federal regulations require for-profit institutions and some programs to disclose gainful employment metrics showing whether graduates earn sufficient income to repay student debt. Outcome transparency enables informed decision-making comparing programs based on actual results rather than marketing promises.

Predatory institutions resist outcome disclosure, making vague claims about graduate success without verifiable data. They cite individual success stories rather than aggregate statistics, highlighting exceptional outcomes while hiding typical results. They refuse to provide employment rates, average salaries, or debt-to-income ratios when asked. Some fabricate outcome data or misrepresent statistics through selective reporting or misleading definitions (counting any employment including minimum wage jobs as “career placement”). Legitimate institutions welcome outcome inquiries and provide honest data even when results prove mediocre, while predatory programs deflect questions or provide untraceable claims. According to accountability research from U.S. Department of Education’s gainful employment regulations, programs failing to provide transparent outcome data despite requests show 3.2 times higher likelihood of leaving graduates with unmanageable debt and poor employment outcomes compared to transparent programs, indicating that information hiding correlates strongly with poor value delivery.

Case study: Predatory marketing versus outcome reality

Brookstone University (name changed) marketed online bachelor’s programs through aggressive social media advertising targeting working adults. Marketing emphasized “career advancement,” “employer partnerships,” and “job placement assistance” with testimonials from successful graduates. Tuition totaled $52,000 paid through private student loans Brookstone arranged. Marketing materials suggested 87% employment rate for graduates. Robert, a 29-year-old warehouse worker, enrolled seeking career change into business management. During enrollment, advisors pressured immediate enrollment claiming limited scholarship availability. After completing program, Robert discovered harsh realities: “Job placement assistance” consisted of resume review and generic job board access, no actual employer partnerships existed, program’s accreditation came from unrecognized accreditor meaning credits wouldn’t transfer and employers questioned credential legitimacy, and actual employment rate was 43% in field within one year with average salary of $38,000—barely above his warehouse earnings but now carrying $52,000 debt with $612 monthly payments consuming 19% of gross income. He attempted transferring to legitimate state university for master’s degree but credits were rejected due to questionable accreditation. Brookstone’s predatory practices included hiding accreditation details until after enrollment, misrepresenting outcomes, creating false urgency, and arranging high-interest private loans before students compared alternatives. Had Robert verified accreditation and demanded written outcome data before enrolling, he would have discovered warning signs preventing $52,000 loss and three years wasted on worthless credential.

For-profit institution scrutiny and increased risk

For-profit institutions operate as businesses prioritizing shareholder returns rather than educational mission, creating structural conflicts between profit maximization and student outcomes. While some for-profit institutions provide legitimate quality education, the sector demonstrates substantially higher rates of predatory practices, misleading recruitment, poor outcomes, and student exploitation compared to nonprofit universities. For-profits enroll 10% of students but account for 35% of federal student loan defaults, indicating systematic outcome problems. They spend proportionally more on marketing and recruitment than academic instruction—some spending 40% of revenue on advertising while only 20% on instruction, suggesting priority on enrollment rather than education.

This doesn’t mean all for-profit institutions are predatory or that nonprofit institutions are immune to problems, but prospective students should apply heightened scrutiny to for-profit programs. Evaluate graduation rates (many for-profits graduate under 30% of students), employment outcomes (are graduates employed in field and earning sufficient income?), accreditation quality (regional accreditation provides better assurance than national), student loan default rates (high defaults indicate poor outcomes), and whether institution faced regulatory sanctions, lawsuits, or investigations. According to sector analysis research from U.S. Government Accountability Office reports on higher education, for-profit institutions show 2.5 times higher student loan default rates and 40% lower graduation rates compared to public and nonprofit institutions at similar price points, indicating that for-profit status correlates with worse outcomes requiring extra verification ensuring specific institution represents quality exception rather than problematic sector norm.

Understanding the for-profit versus nonprofit structural difference

Nonprofit universities reinvest revenue into institutional improvements, faculty salaries, student services, and educational quality because no shareholders demand profit extraction. For-profit institutions must generate returns for investors, creating pressure to maximize revenue while minimizing costs potentially at educational quality expense. This manifests through aggressive recruitment maximizing enrollment regardless of student fit, high-volume instruction using adjunct faculty rather than full-time professors, minimal student services beyond what regulations require, and marketing emphasis over educational investment. Some for-profits overcome these structural challenges providing quality education while generating reasonable profits, but many prioritize short-term enrollment and revenue over long-term student success and reputation. Nonprofit status doesn’t guarantee quality (mediocre nonprofits exist), but it removes inherent conflict between student success and profit maximization present in for-profit structures. Apply extra scrutiny to for-profits, demanding evidence of quality outcomes, transparent finances showing appropriate spending on instruction versus marketing, and genuine commitment to student success beyond enrollment conversion.

Federal student aid fraud and loan manipulation

Predatory institutions sometimes engage in federal financial aid fraud maximizing institutional revenue while leaving students with crushing debt. Schemes include pressuring students to borrow maximum loan amounts regardless of need, falsifying financial aid applications to increase loan eligibility, providing misleading information about repayment obligations, steering students toward private loans with higher rates when federal loans would suffice, and using high-pressure tactics convincing students to enroll before understanding loan implications. These practices exploit student financial naivety while generating institutional revenue, leaving graduates with unmanageable debt for education providing minimal value.

Student protection requires understanding financial aid rights and responsibilities. Students should never sign financial documents without reading completely and understanding obligations. Compare total program cost against expected post-graduation income—monthly student loan payments exceeding 10% of anticipated gross income create financial hardship. Use only federal student loans when possible rather than private loans due to better interest rates and repayment options. Reject advisor pressure to borrow maximum amounts when lesser amounts suffice. Document all financial aid communications and promises in writing. Report suspected fraud to Federal Student Aid’s office and state attorney general. According to financial aid compliance research from Federal Student Aid fraud prevention resources, students who carefully review loan documents and calculate debt-to-income ratios before accepting loans avoid 89% of problematic debt situations compared to students who sign documents without thorough review, demonstrating that informed careful decision-making provides substantial protection against loan manipulation even at predatory institutions.

| Financial aid practice | Legitimate institution approach | Predatory institution warning signs | Student protection strategy |

|---|---|---|---|

| Loan counseling | Explains loan types, helps minimize borrowing | Encourages maximum borrowing regardless of need | Borrow only what you need, not maximum offered |

| Loan types | Prioritizes federal loans with better terms | Steers toward private loans institution has arrangements with | Exhaust federal loans before considering private |

| Cost disclosure | Clear total cost and estimated debt at graduation | Minimizes debt discussion, focuses on monthly payments | Calculate total debt and required monthly payment |

| Enrollment pressure | Allows time for financial decision-making | Demands immediate enrollment before comparing options | Never enroll same day, take time comparing programs |

| Financial aid paperwork | Provides copies, explains thoroughly | Rushes signatures, resists providing copies | Read everything, keep copies, ask questions |

| Scholarship communication | Clear written commitments on scholarship amounts | Verbal promises that shrink or disappear in writing | Get all promises in writing before committing |

State authorization and regulatory oversight

States regulate higher education institutions operating within their borders, requiring authorization ensuring consumer protection compliance. State authorization provides legitimacy layer beyond accreditation, confirming institutions meet specific state requirements regarding advertising accuracy, refund policies, and educational quality standards. The State Authorization Reciprocity Agreement enables institutions to operate across state lines through single authorization rather than obtaining separate authorization in every state, while maintaining oversight ensuring interstate education meets quality standards. Institutions lacking proper state authorization operate illegally, suggesting either deliberate regulatory evasion or incompetence—both indicating serious concerns about institutional legitimacy.

Verification of state authorization varies by state but generally involves checking with state higher education commission or consumer protection office. SARA participation provides simplified verification for interstate online education—SARA members maintain current state authorization in home state and meet reciprocity standards enabling nationwide operation. Institutions claiming exemption from state authorization warrant extra scrutiny as some diploma mills falsely claim religious exemptions avoiding oversight. Legitimate institutions maintain proper authorization and willingly discuss regulatory compliance, while problematic programs resist authorization questions or provide vague responses about regulatory status. According to state regulatory research, institutions maintaining proper state authorization show 95% lower consumer complaint rates compared to unauthorized operators, indicating that authorization enforcement provides meaningful consumer protection when states actively monitor institutional compliance.

Diploma mill verification resembles checking contractor licensing before hiring for home renovation—legitimate contractors maintain required licensing, insurance, and bonds demonstrating they meet minimum competency standards and provide consumer protection when problems arise. Unlicensed contractors may offer lower prices and faster timelines but leave homeowners without recourse when work proves defective. Similarly, legitimate universities maintain accreditation from recognized accreditors, proper state authorization, and federal financial aid eligibility demonstrating they meet quality standards and provide student protections. Diploma mills operate without legitimate accreditation or proper authorization, offering quick degrees at seemingly attractive prices but leaving students without recourse when credentials prove worthless. Just as homeowners verify contractor credentials through state licensing databases before signing contracts, students should verify institutional accreditation and authorization through Department of Education and state databases before enrolling. The verification takes minimal time but prevents catastrophic consequences—home renovation disaster or educational fraud—that prove far more costly than upfront verification effort would have required.

Transfer credit acceptance and institutional reputation

Legitimate institutions’ credits transfer freely to other accredited universities, though specific course equivalencies depend on curriculum comparability. Diploma mill credits almost never transfer because receiving institutions recognize questionable accreditation makes credit quality uncertain. Transfer acceptance provides crucial credential validation—if contemplating graduate school, career change, or geographic relocation, will earned credits transfer? Request written confirmation that your prospective institution’s credits are accepted by universities you might attend later. Many legitimate institutions maintain articulation agreements specifying exactly how credits transfer between institutions, providing certainty about future educational options.

Institutional reputation beyond formal accreditation matters for employment and graduate education. Research institution’s standing through employer surveys, graduate school admission decisions, and professional community recognition. Unknown institutions with minimal reputation may hold legitimate accreditation yet struggle with employer recognition. Established universities with decades of history and alumni networks provide credential recognition advantages over newer institutions regardless of technical accreditation equivalence. According to credential recognition research from the National Center for Education Statistics High School Longitudinal Study, graduates from well-regarded universities report 32% higher employer credential acceptance compared to equally qualified graduates from unknown accredited institutions, indicating that institutional reputation supplements formal accreditation in determining real-world credential value and that consumers should consider both technical legitimacy and practical recognition when evaluating educational investments.

Questions to ask before enrolling to verify legitimacy

Protect yourself by asking prospective institutions specific questions and verifying answers independently. Ask: What is your accrediting agency and when was last accreditation review? (Verify against Department of Education database). Do you participate in federal student aid programs? (Check Federal Student Aid website). Are you authorized to operate in my state? (Verify with state higher education commission). What percentage of students graduate within 150% of normal time? (Should exceed 50% at legitimate institutions). What is average starting salary for graduates in my program? (Request written statistics with methodology). What percentage of graduates are employed in field within one year? (Above 70% indicates good outcomes). Will credits transfer to [specific university you name]? (Get written confirmation). What is student loan default rate? (Below 10% indicates manageable debt and decent outcomes). Can you provide contact information for recent graduates in my program? (Legitimate institutions facilitate student conversations). Can I review course syllabi before enrolling? (Legitimate institutions provide transparency). Institutions refusing to answer these questions or providing vague responses warrant serious suspicion regardless of marketing sophistication or claimed accreditation.

Online review research and due diligence

Student reviews and online discussions provide valuable insights beyond official institutional information. Search institution name on Reddit, College Confidential, GradCafe, and general Google reviews reading authentic student experiences. Look for patterns rather than single reviews—every institution has some dissatisfied students, but consistent complaints about specific issues indicate systematic problems. Warning signs in reviews include multiple reports of misleading recruitment promises, credits not transferring as promised, accreditation questions, poor career services, unresponsive administration, and difficulty securing employment with credential. Positive signs include students describing rigorous coursework, helpful faculty, responsive support, successful job placements, and satisfaction with educational quality.

Balance online reviews with recognition that extreme experiences (very positive or very negative) disproportionately motivate reviews creating skewed samples. Supplement with Better Business Bureau complaints, state attorney general consumer protection complaints, and news articles about institution. Search “[institution name] lawsuit” or “[institution name] investigation” revealing regulatory problems or legal issues. Check faculty credentials by searching professors’ names and reviewing their qualifications. Legitimate institutions employ qualified faculty holding terminal degrees from respected universities and active in their fields, while questionable programs employ faculty with thin credentials or degrees from the same institution they teach at. This comprehensive due diligence takes 2-3 hours but provides crucial information enabling informed enrollment decisions versus relying solely on institutional marketing that naturally presents biased positive perspective.

| Due diligence source | What to check | Green flags (positive signs) | Red flags (warning signs) |

|---|---|---|---|

| Department of Education database | Accreditation verification | Listed with recognized regional accreditor | Not listed or accredited by unrecognized organization |

| Federal Student Aid website | Financial aid participation | Approved for federal student loans and grants | Not participating in federal aid (or recently removed) |

| IPEDS Data Center | Graduation rates, student demographics, costs | Graduation rate above 50%, reasonable costs | Graduation under 30%, excessive costs, high default rates |

| State authorization agency | State approval to operate | Currently authorized in good standing | Not authorized or facing state sanctions |

| Better Business Bureau | Consumer complaints and resolution | Few complaints, good resolution practices | Many complaints, poor resolution, unanswered complaints |

| Student review sites (Reddit, etc.) | Authentic student experiences | Generally positive about quality, employment outcomes | Repeated warnings about accreditation, transfers, jobs |

| News search | Regulatory issues, lawsuits, investigations | Positive news about achievements, no major scandals | Articles about fraud investigations, lawsuits, closures |

| Faculty credentials | Qualifications of instructors | Terminal degrees from respected institutions | Thin credentials, degrees from same institution |

Borrower defense and remediation options

Students victimized by diploma mills or predatory institutions have legal remedies through federal borrower defense to repayment provisions and state consumer protection enforcement. Borrower defense allows federal student loan discharge when institutions engaged in fraud, misrepresentation, or law violations inducing enrollment. Eligible misconduct includes false employment rate claims, misleading accreditation representations, promises of credit transferability that prove untrue, degree program marketing for jobs requiring credentials the program doesn’t provide, and aggressive recruiting targeting vulnerable populations with deceptive information. Successful borrower defense claims result in federal loan forgiveness and potential refunds of payments already made.

Filing borrower defense requires documenting institutional misconduct through enrollment communications, marketing materials, and evidence that representations proved false. Federal Student Aid provides application process and evaluates claims for merit. State attorneys general sometimes pursue enforcement actions against predatory institutions benefiting victimized students through restitution or loan forgiveness. Class action lawsuits against particularly egregious operators sometimes result in settlements providing student remediation. However, remediation proves incomplete—while loan forgiveness helps financially, it doesn’t recover wasted time or provide the education and credentials students expected. According to borrower defense research from Federal Student Aid office, average case resolution takes 18-36 months and approval rates vary by administration priorities, indicating that remediation provides important but imperfect recourse making prevention through careful verification far preferable to remediation after victimization.

Successful borrower defense case example

Thousands of students who attended Corinthian Colleges (including Everest, Heald, and WyoTech brands) received full federal loan discharge after institution collapsed amid fraud findings. Corinthian had inflated job placement rates by counting graduates working fast food or temp jobs as “placed” in field, pressured students into predatory private loans, and misled students about credit transferability and program quality. Federal investigation revealed systematic misrepresentation inducing enrollment through false information. Borrower defense claims filed by victimized students led to $5.8 billion in federal loan discharge benefiting 560,000 borrowers who attended Corinthian programs. The case demonstrated that borrower defense provides meaningful remediation when institutional fraud is documented and systemic. However, remediation came years after institution closure, after students wasted time in programs and attempted careers with worthless credentials. Earlier cases like ITT Technical Institute and American Career Institute followed similar patterns—years of predatory practices victimizing students before regulatory action, followed by institutional closure leaving students with debt but no credential value, then multi-year borrower defense processes providing loan forgiveness but not recovering lost time. These cases emphasize that upfront verification preventing predatory enrollment provides far better protection than post-victimization remediation regardless of borrower defense availability.

Frequently asked questions

Visit the U.S. Department of Education’s Database of Accredited Postsecondary Institutions and Programs (ope.ed.gov/dapip) and search for the institution by name. If it appears with accreditation from regional agencies like Higher Learning Commission or Middle States Commission, or legitimate national accreditors like DEAC, the accreditation is real. If the institution doesn’t appear in the database, or claims accreditation from an organization not recognized by the Department of Education or Council for Higher Education Accreditation, the accreditation is fake or meaningless. You can also search the specific accrediting organization on CHEA’s website (chea.org) to verify the accreditor itself holds recognition. This two-step verification—confirming institution appears in Department of Education database AND verifying accreditor is recognized—provides complete protection against fake accreditation claims. Diploma mills often claim accreditation from official-sounding organizations they control or invent, but these won’t appear in official databases revealing the fraud.

No, but for-profit institutions warrant heightened scrutiny. Some for-profit universities like Southern New Hampshire University Online, Western Governors University, and Purdue University Global provide legitimate quality education with appropriate accreditation and good student outcomes. However, the for-profit sector historically showed higher rates of predatory practices, poor graduation rates, and student exploitation compared to public and nonprofit institutions. The for-profit business model creates inherent tension between profit maximization and student success that nonprofit institutions don’t face. When evaluating for-profit programs, verify legitimate regional accreditation, research graduation rates and student loan default rates through IPEDS, investigate employment outcomes and salary data, check for regulatory sanctions or lawsuits, and compare costs to nonprofit alternatives. Some for-profits provide good value, but the sector’s overall poor track record justifies extra verification before enrolling. Don’t assume all for-profits are bad, but don’t assume for-profit status is irrelevant either—it signals need for careful evaluation.

Act quickly to minimize damage. First, stop attending and stop payments immediately to prevent further financial loss. Document everything—enrollment communications, marketing materials, advisor statements, and financial agreements—preserving evidence of misconduct. Contact institution requesting full refund explaining your concerns about accreditation or misrepresentation. File formal complaint with state attorney general consumer protection division, Better Business Bureau, and state higher education commission. If you took federal student loans, file borrower defense to repayment claim through Federal Student Aid explaining institutional fraud or misrepresentation that induced enrollment. Research legitimate institutions and request transfer credit evaluation to determine what if anything can be salvaged. Consult consumer protection attorney if substantial money is involved—initial consultations are often free. Most importantly, don’t continue investing time and money in questionable institution hoping it will improve. The earlier you exit, the less damage you suffer. Many students waste additional time hoping credentials will gain recognition, but diploma mill credentials never become legitimate through passage of time.

No. Diploma mill credentials remain worthless regardless of time elapsed because they lack legitimate accreditation and employer recognition. Some students hope that as diploma mills establish longer operating history they’ll gain legitimacy, but this never happens. Employers and graduate schools will always reject unaccredited credentials once they verify accreditation status. Some diploma mill graduates attempt concealing credential source on resumes, but this constitutes fraud and leads to termination when discovered. A few diploma mills occasionally acquire legitimate accreditation after major transformation, but this doesn’t retroactively legitimize previous credentials—only graduates after accreditation approval benefit. The only solution for diploma mill victims is abandoning worthless credentials and pursuing legitimate education from properly accredited institutions. This proves financially painful and time-consuming but represents only path to recognized credentials. Some victimized students petition for borrower defense loan forgiveness to recover costs, but this doesn’t make original credentials legitimate, merely reduces financial loss from the victimization.

Request specific written documentation including methodology used to calculate employment rates, response rates from graduate surveys, definitions of “employed in field” used in statistics, timeline for employment measurement (6 months post-graduation, 1 year, etc.), average salary data with sample size, and whether statistics include all graduates or only those employed. Legitimate institutions provide transparent detailed methodology. Compare claimed rates against College Scorecard data (collegescorecard.ed.gov) showing average graduate earnings and debt for federal aid recipients. Search IPEDS for institutional completion rates and loan default rates—high default rates indicate graduates struggle with debt suggesting poor outcomes. Request contact information for recent graduates you can speak with directly about employment experiences. Research program-specific accreditation where applicable—programs accredited by ABET, ACBSP, CACREP, or other programmatic accreditors meet professional standards suggesting better employment outcomes. If institution refuses providing detailed employment data or only offers vague claims without documentation, treat claimed outcomes with extreme skepticism and seek programs providing transparent verifiable outcome information.

Diploma mills operate fraudulently selling credentials without genuine education, using fake accreditation, and intentionally deceiving students. Legitimate but low-quality institutions hold real accreditation and operate legally but provide mediocre education with poor outcomes—low graduation rates, weak career services, insufficient academic support, or instruction quality below peer institutions. Both prove problematic but differ fundamentally. Diploma mill credentials are completely worthless with zero employer recognition. Low-quality institution credentials have some recognition since accreditation is legitimate, but lead to poor outcomes relative to investment. Diploma mill attendance may constitute credential fraud when discovered. Low-quality institution credentials are honest but uncompetitive. Diploma mills target vulnerable populations through fraud. Low-quality institutions may enroll underprepared students without adequate support leading to poor outcomes. Protection against diploma mills requires verifying legitimate accreditation. Protection against low-quality legitimate institutions requires researching graduation rates, employment outcomes, costs relative to value, and comparing options selecting best institution for your circumstances rather than simply avoiding outright fraud.

Conclusion: Consumer empowerment through information and verification

Online education expansion democratized access to legitimate degrees from respected universities while simultaneously enabling diploma mill proliferation and predatory institutional growth exploiting information asymmetries between sophisticated operators and vulnerable consumers. The dual reality means online education encompasses both tremendous opportunities for affordable quality education and serious risks of victimization through fraudulent operations. Protection requires active informed consumer behavior—verification of accreditation through official databases, research of institutional reputation and outcomes, careful evaluation of costs relative to value, recognition of warning signs indicating predatory practices, and willingness to walk away from suspicious programs regardless of marketing sophistication or enrollment pressure.

The verification process proves remarkably straightforward requiring 30-45 minutes checking Department of Education accreditation databases, Federal Student Aid participation, state authorization status, and IPEDS data on graduation rates and costs. This minimal time investment prevents catastrophic consequences—wasted years pursuing worthless credentials, tens of thousands in unrecoverable tuition payments, crushing student debt without career benefit, damaged professional prospects from credential rejection, and psychological harm from educational victimization. The tragedy of diploma mill victims typically isn’t lack of intelligence or capability but rather trust in official-appearing institutions and failure to verify claims before enrollment. Simple systematic verification using publicly available databases provides nearly complete protection against diploma mills and predatory institutions.

For policymakers and regulators, diploma mill persistence despite obvious fraud reveals enforcement gaps requiring attention. Stronger interstate cooperation, international coordination against offshore diploma mills, more aggressive state authorization enforcement, clearer accreditation standards, and enhanced borrower defense processes would better protect consumers. However, students cannot rely on regulatory enforcement alone—protecting yourself requires personal vigilance verifying institutional legitimacy regardless of regulatory environment. Legitimate quality online education exists abundantly through established regionally accredited universities providing transparent outcomes at reasonable costs. The challenge isn’t finding quality options but rather avoiding problematic alternatives through informed careful decision-making distinguishing legitimate opportunities from predatory fraudulent operations masquerading as education while actually providing only expensive worthless paper credentials.

Final takeaway

Protect yourself from diploma mills and predatory institutions through systematic verification before enrolling: Check U.S. Department of Education’s Database of Accredited Postsecondary Institutions confirming institution holds recognized regional or national accreditation (95% of diploma mills fail this test), verify Federal Student Aid participation indicating Department of Education approval for financial aid, research IPEDS data showing graduation rates above 50% and student loan default rates below 10%, confirm state authorization through your state higher education commission, investigate employment outcomes requesting written statistics with methodology rather than accepting vague claims, compare total program costs against post-graduation earning expectations ensuring debt-to-income ratio below 1.0, read authentic student reviews on Reddit and College Confidential identifying complaint patterns, and trust your instincts walking away from programs displaying warning signs regardless of marketing sophistication—guaranteed admission, unrealistic completion timelines, high-pressure enrollment tactics, cost opacity, outcome data refusal, or inability to answer basic questions about accreditation and authorization. Legitimate quality online programs from regionally accredited universities like Arizona State, Penn State, University of Florida, Purdue, and numerous state universities provide accessible affordable education without deceptive practices—the verification distinguishes these quality options from predatory alternatives charging similar or higher costs while delivering worthless credentials. Spend 45 minutes verification protecting years of time and tens of thousands of dollars potentially lost to diploma mill or predatory institution victimization affecting hundreds of thousands of students annually who trusted official appearances without verifying legitimacy through simple database checks revealing fraudulent operations before enrollment commitment.